Futurist Society Visibility Success

Investor Relations Case Study Portfolio

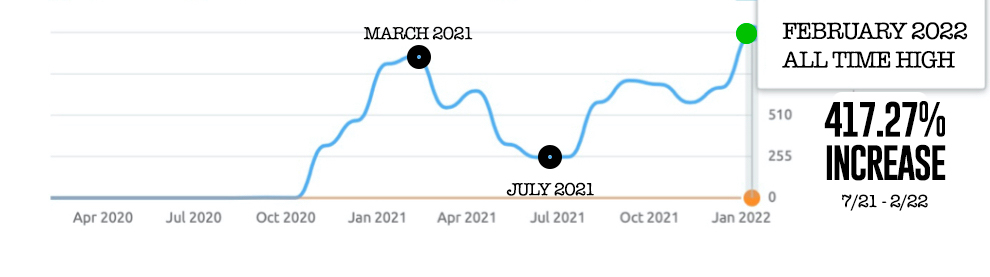

The case study company featured below went public via IPO on the Nasdaq Stock Market in December 2020.

Futurist Society was engaged as an investor relations firm and began implementing their proprietary marketing approach to increase visibility and awareness in July of 2021. The company was near its 52 Week Low as well as the lowest amount of organic traffic and visibility it had experienced since IPO.

In less than 6 months, the team at Futurist Society through a strategic and algorithmic focused approach were able to increase the traffic to match the highest level since IPO over 1 year ago with increased elevation expected into 2022.

We Understand Retail Investors & Institutional Investors

An investor relations case study can be used to benchmark a company’s investor relations program against its peers and the financial community. It can also be used to identify areas where a company’s investor relations program can be improved.

The above case study provides a detailed analysis of how Futurist Society lifted website traffic and visibility for a microcap client. This showcases the effectiveness of our company’s investor relations strategy and demonstrates the best practices for a public company among both retail investors, institutional investors and other constituencies.

Some key areas that are typically analyzed in an investor relations case study include the objectives, target audience, strategy, tactics, budget, team, performance, shareholder base, stock price performance, annual report, financial statements, SEC filings, investor presentations, analyst coverage, media coverage, web traffic, investor inquiries, number of shareholders, institutional ownership, analyst ratings, target price, short interest, and volatility.

An investor relations case study can be an extremely valuable tool for companies looking to improve their investor relations programs. Whether it is a new CEO request review or a challenge by management to develop depth strategies that focus on development of the organization prospecting, benchmarking their program against peers and identifying areas for improvement companies can make their Investor Relations programs more effective and efficient.

Our portfolio of case studies we have prepared highlights the success of Futurist Society investor relations services. We have a proven track record of success in helping our clients tell their story throughout the world and achieve desired results that matter improving their shareholder communication and overall financial performance.

Futurist Society is a full service investor relations firm. We offer a complete suite of global services, from developing the content and message for investor communications at launch to financial analysis, media relations and general market intelligence. Our goal is to support our clients achieve their desired results through a new IR perspective that continues to deliver information based on a controlled narrative in mind.

We are proud of our track record of success and our commitment to help our partners build and engage with potential investors and existing shareholders on terms they set along with developing a roadmap for the road ahead and challenges they may face.

Elements of Investor Relations Case Studies

An investor relations case study is a detailed analysis of how a business manages its successful investor relations. It can be used to improve the effectiveness of a company’s investor relations strategy and help identify best practices or developing new ways of highlighting the impact or learn from experience the best ways to communicate.

A typical investor relations case study can include an analysis of the following areas of a public company:

-The company’s investor relations objectives

-The company’s target audience

-The company’s investor relations strategy

-The company’s investor relations tactics

-The company’s investor relations budget

-The company’s investor relations team

-The company’s investor relations performance

-The company’s shareholder base

-The company’s share price performance

-The company’s annual report

-The company’s financial statements

-The company’s SEC filings

-The company’s investor presentations

-The analysts’ coverage of the stock

-The media coverage of the stock

– The web traffic to the investor relations website

-The number of investor inquiries

-The number of shareholders

-The number of institutions owning the stock

-The level of institutional ownership

– The analyst ratings on the stock

– The target price for the stock

– The short interest in the stock

– The volatility of the stock